The Orange Options program is a small guide to option strategies with option pricing calculator (absolutely free, no ads).

Basic features:

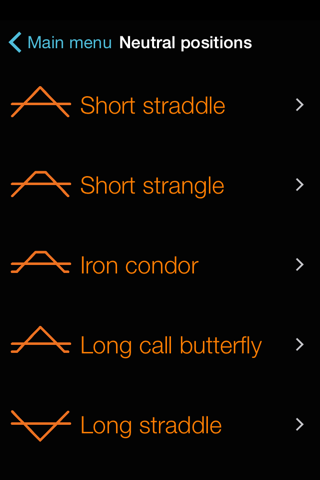

Options trading strategies

Options pricing

Option "Greeks"

Vertical, horizontal and diagonal strategies (Calendar spreads)

Strategies graph (Profit and Loss diagram for options strategies)

Calculations are performed according to the Black - Scholes - Merton formula.

Glossary of notation

Break-Even Point (BEP): The stock price(s) at which an option strategy results in neither a profit nor a loss.

Volatility: A measure of the fluctuation in the market price of the underlying security. Mathematically, volatility is the annualized standard deviation of returns.

Interest rate: Risk-free interest rate.

Stock price: Price of underlying asset .

Greeks: The options sensitivities, partial derivatives of the Black - Scholes - Merton formula.

Delta: The option’s sensitivity to small changes in the underlying asset price.

Gamma: The delta’s sensitivity to small changes in the underlying asset price.

Vega: The option’s sensitivity to small changes in the volatility of the underlying asset price.

Theta: The option’s sensitivity to small changes in time to maturity.